Сlinical Trials in Georgia 2024

Georgia, a country nestled between Eastern Europe and Western Asia, has emerged as a promising destination for clinical trials. With its strategic location and favorable regulatory environment, Georgia has become increasingly attractive to international sponsors seeking to conduct innovative research projects.

Since 2013, Cromos Pharma has been at the forefront of managing clinical research in Georgia, establishing a strong presence in Tbilisi, and overseeing a multitude of successful regional and global studies across various therapeutic areas. The country’s burgeoning clinical research landscape has experienced exponential growth, offering ample opportunities for novel studies and rescue clinical trials.

One of the key advantages of conducting clinical trials in Georgia is its efficient regulatory approval process. Sponsors benefit from a streamlined pathway to regulatory clearance, allowing for expedited study initiation and execution. Additionally, Georgia boasts significant untapped patient populations across diverse therapeutic areas, providing researchers with access to a wide range of participants for their studies. Moreover, the country is home to skilled medical personnel who are well-equipped to support clinical research initiatives. Combined with a conducive economic environment for business, Georgia offers a compelling proposition for sponsors looking to advance their research objectives.

Country Overview

Georgia, officially known as the Republic of Georgia, is located at the crossroads of Eastern Europe and Western Asia. Situated between the Black Sea to the west and the Caspian Sea to the east, Georgia shares borders with Russia to the north, Azerbaijan to the southeast, Armenia to the south, and Turkey to the southwest. Its strategic position allows for significant cultural, economic, and geopolitical interactions with neighboring countries.

On December 14, 2023, the European Commission granted Georgia EU candidate status, further solidifying its role in the region’s development. According to the most recent United Nations World Statistics Pocketbook, its land area covers more than 69,000 square kilometers. Georgia offers a diverse landscape ranging from coastal plains along the Black Sea to high mountain ranges in the north. The country’s geographical diversity contributes to its rich biodiversity and varied climate, making it an ideal setting for a wide range of clinical research studies.

Demographics

The World Bank data from 2022 indicates that there are more than 3.7 million people, and the country’s estimated GDP is $19.8 billion.

Moreover, Georgia’s research culture is on the rise, as reflected in its Global Innovation Index ranking, where it holds a prominent position in the region. As of 2023, Georgia ranks among the top countries, showcasing its growing capability to conduct innovative research across various fields, including medical research.

Socioeconomics

Georgia’s capital is Tbilisi, which is also the largest and most densely populated city in the country. Due to their significant population concentrations and advanced medical infrastructure, urban centers serve as focal points for potential clinical trial participants.

Georgia’s key trade partner is the European Union (EU), with whom it conducts trade under various agreements. Georgia enjoys a robust trade relationship with the EU, marked by the Deep and Comprehensive Free Trade Area (DCFTA) agreement. According to World Statistics Pocketbook, Georgia’s other significant trade partners include countries such as Türkiye, China, and Azerbaijan. Positioned at the crossroads of Europe and Asia, Georgia serves as a key transit hub for international trade, enhancing its significance in global trade networks.

Maintaining diplomatic relations with neighboring countries enhances Georgia’s access to vital resources crucial for supporting the clinical research sector and fostering economic growth.

At a Glance: Georgia’s Health and Pharmaceutical Industry

- As of the year 2021, the life expectancy at birth is 72 years. The share of people older than 69 is 6.1%.

- Data from UNICEF (2021) indicate that the infant mortality rate is 9.5 deaths per 1000 live births.

- The pharmaceutical market in Georgia is projected to reach $127.70 million by 2024, with a focus on oncology drugs. The market is driven by increasing demand fueled by rising health awareness. Supported by macroeconomic factors like economic growth and healthcare expenditure, the market shows promising potential for further expansion and development.

Status of the Healthcare Sector in Georgia

The healthcare sector in Georgia has demonstrated significant growth and development over the past decade. From 2013 to 2022, the sector’s output exhibited a consistent upward trajectory, reaching $888.9 million in 2022, marking a substantial increase of 2.6 times compared to 2013. This growth reflects a Compound Annual Growth Rate (CAGR) of 10%, showcasing the sector’s resilience and potential for expansion.

Georgia’s healthcare landscape is characterized by a diverse array of participants, contributing to high levels of competition within the sector. Despite the challenges posed by the COVID-19 pandemic, which impacted clinic revenues and expenses in 2020, subsequent years saw significant recovery, with the EBITDA margin increasing to 25% in 2021. Moreover, with the expansion of the state’s universal healthcare program and targeted initiatives such as organ transplantation, the healthcare sector in Georgia is poised for further growth and development.

Reasons to Conduct Clinical Trials in Georgia

Despite its small size, Georgia offers significant advantages for sponsors, such as a diverse, treatment-naïve population with limited access to novel therapies and a favorable business environment fostered by recent economic reforms, health system improvements, including a universal healthcare system implemented in 2013, increased healthcare investment, a growing number of physicians, and the modernization of health data collection.

- The country boasts 172 registered investigational sites, demonstrating its growing potential for clinical trials.

- Clinical trials conducted in Georgia adhere fully to ICH GCP guidelines.

- Georgia’s rapidly growing clinical trial-related workforce is well experienced in international, ICH GCP-compliant clinical trials.

- Data collected from these trials is consistently of high quality and meets the standards of both the FDA and EMA.

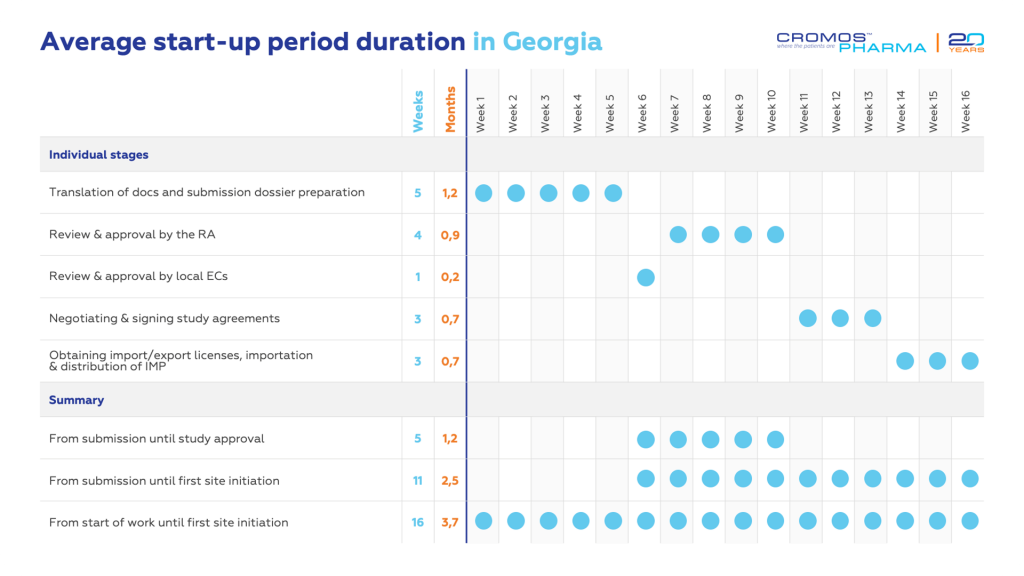

- Georgia boasts a swift approval process for clinical trials, typically initiating within up to two months.

- Conducting clinical research in Georgia is significantly more cost-effective than in the United States and Western Europe.

- Georgia’s investment in the healthcare sector over the last decade has increased the number of medical facilities and in-patient beds.

- Good recruitment potential due to an ethnically diverse population with treatment-naive patients in a broad range of therapeutic areas.

Regulatory Framework for Clinical Research in Georgia

- Regulatory approval process

Georgia’s efficient regulatory agencies enable clinical trial approvals in less than two months. The Permission issued for the clinical trial acts as an import/export license for IMP. The process necessitates Local Ethics Committees’ (LEC) approval before submission to the Ministry of Internally Displaced Persons from the Occupied Territories, Labor, Health and Social Affairs (MOLHSA), hereinafter referred to as the Regulatory Authority (RA).

- Agreements with sites and investigators

Most medical institutions utilize a tripartite contract model (CRO or Sponsor/Institution/PI, with the PI’s signature for acknowledgment) for clinical trials, which is bilingual and ensures that payments are processed through the institution, simplifying compensation for investigators and staff. In some cases, a bipartite agreement (CRO or Sponsor /PI and/or SI) may be required and requested in addition to the above-mentioned tripartite contract with split payments between the medical institution and PI and/or SI. The local Cromos Pharma team swiftly negotiates these agreements without needing submission to the LEC/RA. Payments should be made in either USD or Euro.

- LEC review and approval

The LEC for each clinical trial is established at medical institutions, adhering to ICH-GCP and local requirements. Approvals are granted within 7 days of submission. After getting approvals from all LECs, the clinical trial documentation is submitted to the RA. If there are no questions from the RA side, approval is granted within 30 calendar days of submission.

- Import-export license

The import-export process for clinical trials in Georgia follows specific guidelines based on the type of materials involved. For the Investigational Medicinal Products (IMP), the Clinical Trial Permission issued by the RA of Georgia serves as the authorization for its importation, meaning no separate import license is required.

However, an additional permission letter is necessary for comparator or concomitant medications. The RA issues this document within 10 working days following the submission of the relevant request, and import/export licenses must be obtained for these medications, to ensure their proper importation and distribution.

Additionally, if laboratory tubes contain active substances, a separate import license will be required specifically for those materials.

- Trial sites’ location

Georgia’s major medical institutions are concentrated in Tbilisi and regional centers, spanning up to 400 km from the capital, to cover the nation’s healthcare needs.

- Legal entity

Georgian regulations mandate that a local legal entity (CRO) submit and hold the clinical trial authorization. The licensee is liable for all activities under that permit as stipulated by the local laws, including the Civil Code of Georgia, Law on Pharmaceutical Activities, and the Law of Georgia about Permissions and Licenses, even if tasks are delegated to a third party.

- QP Declaration / GMP certificate

Submission requires Manufacturer Authorizations (MA) and GMP certificates for all entities involved in the drug production process (IMP and NIMP), complying with GMP standards recognized by WHO, the European Commission, the FDA, or the Pharmaceutical Inspection Cooperation Scheme (PIC/S). A Qualified Person (QP) statement may also be acceptable in certain cases.

- Required Documentation for Initial Submission

In addition to the standard package of core documents, the initial submission documentation must include labels for IMP and Non-Investigational Medicinal Products (NIMP), as well as a draft of the Electronic Case Report Form (eCRF). These are essential components of the application and are mandatory for processing.

- Patient Insurance

Clinical trial insurance, covering any trial-related health injuries to participants, is required and must be provided by a local insurance company. When coordinated through Cromos Pharma’s local office, this process is typically completed within 5 to 10 business days.

- Medical Devices trials

New regulations came into force in 2023 regarding clinical trials performed with medical devices, making conducting this kind of clinical trial more streamlined and regulated.

- Notarization and Apostille Requirements

The Letter of Authorization (LoA), Power of Attorney (PoA), and any other authorization documentation must be notarized and apostilled in the country of issuance. Additionally, two original wet ink copies of each document must be provided to the local CRO for further submission to the RA.

- Global Patient Enrollment Data

As part of the initial application, information regarding the status of clinical trial approvals and the number of patients already enrolled worldwide must be included. Specifically, for Phase 1 clinical trials, the RA requires data on the approval of the Phase 1 study in any of the 39 countries1 recognized by the Ordinance of the Government of Georgia No. 188, along with details on patient enrollment.

- Study Registration Documentation

Furthermore, the initial submission must include documented registration of the study on clinicaltrials.gov. Additionally, the submission should include either the European Union Drug Regulatory Authorities Clinical Trials Database (EudraCT) / EU CT numbers or the Investigational New Drug (IND) application, complete with the relevant IND Number, EudraCT/EU CT Number, or National Clinical Trial (NCT) Number.

- Official Language

The official language is Georgian. All non-state language documentation should be submitted with local notarial-certified Georgian translations.

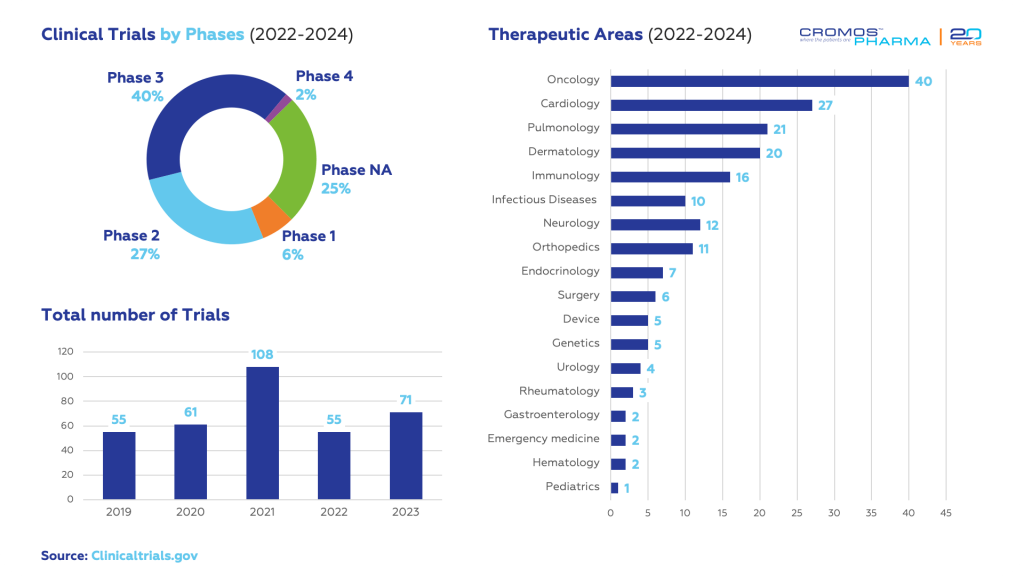

Snapshot of Georgia’s Clinical Trials

Georgia has seen a significant increase in clinical trial activity in recent years, with studies spanning various therapeutic areas, including oncology, cardiology, and infectious diseases. The collaborative efforts of stakeholders, combined with favorable regulatory conditions, position Georgia as a promising hub for clinical research.

According to data obtained from clinicaltrials.gov, 126 clinical trials have been initiated in Georgia since 2022. The largest share is in oncology (40), followed by cardiology (27) and dermatology (20).

Cromos Pharma – A Contract Research Organization operating in Georgia

With over a decade of experience in Georgia, Cromos Pharma has established a significant presence in the field of clinical trials. The company is distinguished by a remarkable legacy, highlighted by its successful management of more than 30 trials. A key milestone in its history is the launch of Georgia’s first clinical trial in ophthalmology, marking a transformative phase in eye health research in the region.

Furthermore, in 2023, Cromos Pharma achieved a landmark success by receiving approval to conduct the very first Genetically Modified Organism (GMO) clinical trial. This approval not only represents a historic moment for Cromos Pharma itself but also sets a new benchmark in GMO research globally.

Cromos Pharma has a seasoned team in Georgia with expertise in navigating the regulatory and contracting landscape, enabling them to initiate studies as swiftly as possible. Our workforce is composed of highly qualified and adept individuals, ensuring that each trial we oversee in Georgia is marked by superior data quality and dependable outcomes.

Leveraging global insights with profound local familiarity, Cromos Pharma excels in patient recruitment, achieving or surpassing enrollment targets in 95% of our trials.

If you are interested in pursuing clinical trials in Georgia, Cromos Pharma’s dedicated team is ready to answer any questions you might have.

1 Countries recognized by the Government of Georgia Ordinance No. 188: United States of America, Commonwealth of Australia, Republic of Austria, New Zealand, Kingdom of Belgium, Republic of Bulgaria, Federal Republic of Germany, Kingdom of Denmark, United Kingdom of Great Britain and Northern Ireland, Republic of Estonia, Kingdom of Spain, Ireland, Republic of Italy, Japan, Republic of Iceland, Canada, Republic of Cyprus, Republic of Korea, Grand Duchy of Luxembourg, Republic of Latvia, Republic of Lithuania, Republic of Malta, Kingdom of Norway, Kingdom of the Netherlands, Republic of Portugal, Republic of Poland, Romania, Republic of France, Republic of Greece, Republic of Slovenia, Republic of Slovakia, Republic of Hungary, Republic of Finland, Kingdom of Sweden, Swiss Confederation, Czech Republic, Turkey, Republic of Croatia, State of Israel